Request To Waive Penalty / Letter Request Waiver on Penalty Interest | Social ... : You need to tell us the reason for your late filing, non electronic filing or late payment.

Request To Waive Penalty / Letter Request Waiver on Penalty Interest | Social ... : You need to tell us the reason for your late filing, non electronic filing or late payment.. Section 11 of the skills development levies act and section 12 of the unemployment insurance fund act doesn't offer any. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty. I have savings account no. Penalty waiver request, offer of compromise or protest. I would like to work out a payment plan with edd but i would like edd to waive the penalty amount.

I have savings account no. Request for transcript of tax return. The 10 percent penalty is waived if medical expenses exceed 7.5 percent of your adjusted gross income, you are permanently disabled, a military reservist, your retirement plan is levied by the irs or due to divorce or death of the plan participant. The comptroller's taxpayer bill of rights includes the right to request a waiver of penalties. Interest charged on a penalty will be reduced or removed when that penalty is reduced or removed.

Penalties can be waived because of

I recognize that a mistake was made by me and would rectify the problem. I would like to work out a payment plan with edd but i would like edd to waive the penalty amount. Generally, penalty charges will not be waived unless there are exceptional circumstances, such as if your giro payment for levy failed due to the bank's error. Then provide all of the requested information. 000000000 maintained with your bank since the past 12 years. If you have a tax professional on retainer, they can call the dedicated tax pro hotline or compliance unit to request an. Over the next few months, the irs will. A request can be sent for: Section 11 of the skills development levies act and section 12 of the unemployment insurance fund act doesn't offer any. A penalty exemption will be granted if reasonable cause exists. In this video, i answer the question about if (and when) the irs will waive penalties and interest and i show you exactly how to request the irs to remove. I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only request for waiver of late subcharge of tax. State the reason you weren't able to pay, and provide copies—never the originals—of the documents you're offering as evidence.

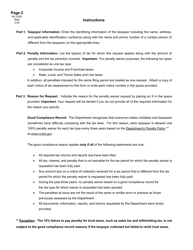

List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered. You'll need to complete form 843, claim for refund and request for abatement, put 80% waiver of estimated tax penalty on line 7 of the form and mail the. Request for transcript of tax return. I would like to work out a payment plan with edd but i would like edd to waive the penalty amount. The 10 percent penalty is waived if medical expenses exceed 7.5 percent of your adjusted gross income, you are permanently disabled, a military reservist, your retirement plan is levied by the irs or due to divorce or death of the plan participant.

I have savings account no.

I have savings account no. You need to tell us the reason for your late filing, non electronic filing or late payment. A request can be sent for: State the reason you weren't able to pay, and provide copies—never the originals—of the documents you're offering as evidence. Then provide all of the requested information. A penalty exemption will be granted if reasonable cause exists. Request for taxpayer identification number (tin) and certification. Reasonable cause may exist when you show that you used ordinary business care and prudence and. List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered. However, to claim the penalty relief, you had to submit irs form 2210 with your 2018 tax return or, if you already filed your 2018 return and paid the underpayment penalty, request a no, says the irs, which will automatically waive the penalty for these taxpayers. If you have been charged a penalty but believe you have reasonable cause (e.g. Section 11 of the skills development levies act and section 12 of the unemployment insurance fund act doesn't offer any. Penalty waiver request, offer of compromise or protest.

You received a letter or notice in the mail from us with penalties and fees. Taxpayer's name (legal name if business) part 2. A request can be sent for: This loss of income may result to a difficulty in paying rent. Reasonable cause may exist when you show that you used ordinary business care and prudence and.

Casualty, disaster) for not complying with the tax laws, you may request a waiver of penalty (abatement of penalty).

Taxpayer's name (legal name if business) part 2. You need to tell us the reason for your late filing, non electronic filing or late payment. To avoid penalties in the future, file or pay by the due date. How to get irs penalties waived or appealed. The cra waived interest on tax debts related to individual, corporate, and trust income tax returns from april 1, 2020, to september 30, 2020 and from april 1, 2020, to june 30, 2020, for goods and taxpayers do not need to make a request for the cancellation of penalties and interest for this period. However, to claim the penalty relief, you had to submit irs form 2210 with your 2018 tax return or, if you already filed your 2018 return and paid the underpayment penalty, request a no, says the irs, which will automatically waive the penalty for these taxpayers. However, if you want to improve your chances of your request being accepted, you should work with. State the reason you weren't able to pay, and provide copies—never the originals—of the documents you're offering as evidence. Casualty, disaster) for not complying with the tax laws, you may request a waiver of penalty (abatement of penalty). You'll need to complete form 843, claim for refund and request for abatement, put 80% waiver of estimated tax penalty on line 7 of the form and mail the. Request for transcript of tax return. 28.09.2020 · writing a waiver penalty letter sample hardship letter a waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you for instance you may be given a citation a penalty fee or a new financial obligation if you feel that such is undeserved or if you feel that. Write a letter to the irs requesting a penalty waiver.

Komentar

Posting Komentar